Car insurance for retired teachers is a crucial aspect of their financial planning, often overlooked in the transition from active work life. This guide delves into the unique needs and considerations for retired educators, examining the specific factors that influence insurance costs and exploring available options.

Retired teachers, with their often predictable driving habits and established financial situations, can find themselves in a unique position when it comes to car insurance. This guide explores how to navigate the complexities of the market, ensuring the best possible coverage at a competitive price.

Understanding the Needs of Retired Teachers

Retired teachers bring a unique set of financial and lifestyle factors to the table when considering car insurance. Their priorities often differ from those of younger drivers, and understanding these nuances is crucial for providing tailored insurance solutions. Their experiences and accumulated wisdom offer valuable insights into responsible driving habits, influencing how they interact with the road and potentially affecting insurance premiums.

Financial Factors Affecting Retired Teachers

Retirement often brings a shift in income, with some teachers experiencing a decrease compared to their working years. This financial reality can impact their ability to afford high premiums, potentially leading to a search for more affordable options. Savings and investments accumulated during their careers might be significant, but their overall financial stability varies. Additionally, health insurance costs and other retirement-related expenses could also influence their financial situation, impacting their decision-making about car insurance.

The availability of pensions and other retirement benefits plays a critical role in determining their financial resources.

Lifestyle Factors and Driving Habits

Retired teachers often enjoy more leisure time, potentially leading to increased driving for activities like visiting family, traveling, or exploring new places. This increased mileage could affect their insurance premiums. Their driving patterns might also differ, potentially involving more local driving and fewer long-distance trips compared to working-age drivers. The need for reliable transportation remains crucial for maintaining independence and connection to their communities, which often drives their car insurance decisions.

Insurance Concerns and Priorities

Safety and affordability often top the list of priorities for retired teachers. They might be more concerned about comprehensive coverage to protect their vehicles from damage or theft. The potential for higher repair costs, due to the age of their vehicles, can also be a significant factor in their insurance considerations. Cost-effectiveness and the availability of discounts are usually of paramount importance.

Driving Habits and Patterns

Retired teachers generally exhibit a more cautious and predictable driving style. Their experience and maturity often translate into safer driving habits. This cautiousness and familiarity with local roads can lead to a lower likelihood of accidents compared to younger drivers. They are more likely to be familiar with the local roads and traffic patterns.

Comparison of Average Car Insurance Costs by Age Group

| Age Group | Average Car Insurance Cost (Estimated) |

|---|---|

| 25-34 | $1,800 – $2,500 per year |

| 35-44 | $1,500 – $2,200 per year |

| 45-54 | $1,300 – $2,000 per year |

| 55-64 | $1,200 – $1,900 per year |

| 65+ | $1,100 – $1,800 per year |

Note: These are estimated figures and can vary based on location, driving history, vehicle type, and other factors. The data is illustrative and not exhaustive.

Typical Vehicle Types and Their Implications

Retired teachers often own a variety of vehicles, including sedans, SUVs, and minivans. The type of vehicle significantly impacts insurance premiums. Older vehicles, common among retired teachers, could lead to higher premiums due to potential repair costs. The specific model, year, and make of the vehicle can also influence the premiums charged. Insurance companies often assess the value of the vehicle to determine the appropriate coverage amount.

Retired teachers, bless their hearts, often find their car insurance rates skyrocket. But hey, if you’re looking for a cozy 2 bedroom apartment in Norman, OK, 2 bedroom apartment in norman ok might just be the ticket. Then again, maybe a lower rate is the real key to a happy retirement – car insurance for retired teachers, am I right?

A larger vehicle like an SUV may come with a higher premium compared to a smaller sedan.

Insurance Options for Retired Teachers

Retiring doesn’t mean saying goodbye to the open road. Maintaining car insurance is crucial for peace of mind, especially when navigating the complexities of everyday driving. This section explores various car insurance options tailored for retired teachers, ensuring you’re adequately protected while enjoying your well-deserved retirement.Understanding the specific insurance needs of retired teachers is vital. Their driving habits, financial situations, and potentially lower incomes require a careful approach to insurance selection.

Different insurers cater to these needs, offering various packages and discounts.

Retired teachers, bless their hearts, need affordable car insurance. But let’s be real, after years of educating the youth, their pockets might be a little thinner than their patience. Fortunately, you can fuel up your post-retirement adventures with delicious pizzas from Jake’s Pizza Bemidji menu, Jake’s Pizza Bemidji menu , so you can afford that extra layer of coverage.

Just remember, that extra pepperoni can be a surprisingly great way to get your insurance premiums down too! So, get ready to hit the road, teachers, and enjoy your well-deserved retirement, while still keeping your wheels in tip-top shape.

Available Car Insurance Policies

A variety of car insurance policies are available to suit different needs and budgets. These policies typically cover liability, comprehensive, and collision. Liability insurance protects you from financial responsibility if you cause an accident. Comprehensive insurance safeguards your vehicle from damages like hail, theft, or vandalism, while collision insurance covers damage to your car resulting from an accident.

Insurance Provider Comparison

Different insurance providers have varying reputations and customer service approaches. Some providers may be known for their competitive rates, while others prioritize exceptional customer service, particularly when dealing with a specific demographic like retired teachers. Consider factors like ease of claims processing and the overall responsiveness of customer service representatives.

Discounts and Special Programs

Many insurance companies offer discounts and special programs specifically for retired teachers. These discounts can often translate into substantial savings on your premiums. These programs are often designed to recognize the contributions of retired teachers to society and reward their continued presence on the roads.

Coverage Options Comparison

| Insurance Provider | Liability Coverage | Comprehensive Coverage | Collision Coverage |

|---|---|---|---|

| Insurer A | $100,000 per person, $300,000 per accident | Covers damages from theft, fire, vandalism, and weather | Covers damage to your car in an accident, regardless of who is at fault |

| Insurer B | $250,000 per person, $500,000 per accident | Covers damages from theft, fire, vandalism, and weather, with a higher deductible option | Covers damage to your car in an accident, regardless of who is at fault, with a lower deductible option |

| Insurer C | $150,000 per person, $400,000 per accident | Covers damages from theft, fire, vandalism, and weather, and includes additional add-ons for roadside assistance | Covers damage to your car in an accident, regardless of who is at fault, with optional rental car coverage |

This table provides a basic comparison of coverage options offered by different insurers. Always review the specific policy details and exclusions for each provider before making a decision.

Discounts and Bundled Packages

Insurance companies frequently offer discounts and bundled packages for retired teachers. These can include discounts for safe driving records, bundled packages for homeowners or renters, and other specialized programs. These offers are frequently available for those who have maintained a consistent record of responsible driving. In some cases, these discounts are designed to incentivize safe driving habits.

Factors Influencing Insurance Costs

Retired teachers, like all drivers, face fluctuating car insurance premiums. Understanding the elements that impact these costs is crucial for budgeting and securing the most suitable coverage. Various factors, including driving history, vehicle specifics, and financial standing, play a significant role in determining the price of car insurance.A comprehensive grasp of these factors empowers retired teachers to make informed decisions regarding their insurance options, ensuring adequate protection without unnecessary financial strain.

This understanding helps navigate the complexities of the insurance market, leading to more affordable and tailored coverage.

Driving History and Claims History

Driving history and claims history are significant determinants of insurance premiums. A clean driving record, characterized by fewer accidents and violations, typically results in lower premiums. Conversely, a history of accidents or traffic violations can lead to higher premiums. Claims history, including frequency and severity of claims filed, also impacts insurance costs. A driver with a history of filing numerous claims, especially for substantial damages, may face significantly higher premiums.

This is because insurance companies assess risk based on past behavior.

Vehicle Type, Usage, and Location

The type of vehicle, its usage, and the driver’s location significantly influence insurance costs. Luxury vehicles, sports cars, and high-performance models often attract higher premiums due to their perceived higher risk of damage or theft. The usage of a vehicle also plays a crucial role. Frequent long-distance driving or use for commercial purposes can increase insurance premiums.

Similarly, location impacts costs. Areas with higher rates of theft or accidents generally command higher premiums. Insurance companies consider factors such as crime rates and traffic density in determining premiums.

Credit Scores and Financial History

Credit scores and financial history can unexpectedly influence car insurance premiums. Insurance companies often use credit scores as an indicator of a driver’s financial responsibility. A lower credit score might suggest a higher risk profile, leading to higher premiums. Financial history, including payment patterns and outstanding debts, also plays a role. Consistent payment history and a strong financial standing typically correlate with lower premiums.

This is because insurers consider drivers with a proven history of responsible financial management as a lower risk.

Comparative Analysis of Factors Impacting Premiums

To illustrate the interplay of these factors, consider a hypothetical scenario. A retired teacher, Sarah, with a clean driving record, owns a standard sedan and lives in a low-crime area. Her credit score is excellent, reflecting a strong financial standing. In contrast, another retired teacher, David, has a history of minor traffic violations, owns a high-performance sports car, and lives in a high-crime area.

David’s credit score is average. Based on these differences, Sarah’s premiums are likely to be considerably lower than David’s. This reflects the significant impact of various factors on insurance costs.

Impact of Driving Habits on Insurance Premiums

| Driving Habit | Location | Mileage (Annual) | Estimated Premium Impact |

|---|---|---|---|

| Safe driving | Low-crime area | 10,000 miles | Lower |

| Occasional speeding tickets | High-crime area | 15,000 miles | Higher |

| Regular aggressive driving | High-accident zone | 20,000 miles | Significantly Higher |

The table above illustrates the varying impacts of driving habits on insurance premiums. Factors such as location, mileage, and driving style all contribute to the risk assessment performed by insurance companies. This ultimately determines the cost of insurance for retired teachers.

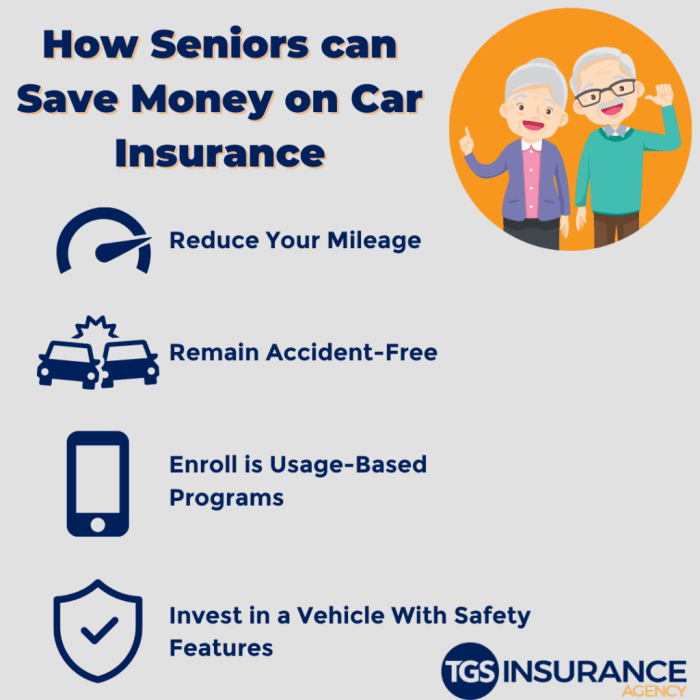

Tips and Strategies for Saving Money

Retiring teachers deserve the best car insurance deals, and savvy strategies can significantly reduce costs. This section explores practical methods for lowering your premiums while maintaining adequate coverage. From smart driving habits to leveraging discounts, we’ll equip you with the tools to save.Understanding your driving habits and lifestyle choices is key to securing the best car insurance. Factors like your age, location, and driving record all play a role in the price you pay.

By proactively adjusting these factors, you can take control of your insurance costs.

Driving Safety and Accident Prevention

Safe driving practices directly impact insurance premiums. Reducing the likelihood of accidents is a crucial step toward lower costs. Consistent adherence to traffic laws, maintaining a safe following distance, and avoiding distracted driving are paramount. Prioritizing these practices reduces your risk of accidents, thereby decreasing your insurance premiums.

Discounts and Bundled Packages

Insurance companies often offer discounts for various factors. Taking advantage of these discounts can significantly lower your premiums. For instance, bundling your car insurance with your homeowners or renters insurance can yield substantial savings. Companies often provide discounts for safe driving, anti-theft devices, and good student discounts. Be sure to inquire about available discounts tailored to your specific situation.

Telematics Devices and Driving Habits

Telematics devices track your driving habits, such as speed, braking, and acceleration. By monitoring these factors, insurers can assess your driving risk more accurately. If your driving profile demonstrates safe habits, you might qualify for lower premiums. Many insurance companies now offer discounts for drivers who use telematics devices, providing a win-win situation for both the driver and the insurer.

Some devices even offer personalized feedback to improve driving style, ultimately reducing the likelihood of accidents.

Comparing Insurance Quotes

Comparing quotes from multiple insurance providers is crucial for getting the best possible deal. Different companies have varying pricing structures, and by comparing quotes, you can find the most competitive rate. A systematic approach to comparing quotes is essential. Gather quotes from at least three to five different providers to ensure you’re getting the most competitive rates.

Consider using online comparison tools or contacting providers directly. Follow these steps:

- Identify your needs and desired coverage. Consider factors such as coverage limits, deductibles, and add-ons.

- Gather information about your vehicle and driving history. This includes your vehicle’s make, model, and year, as well as your driving record.

- Use online comparison tools or contact insurance providers directly to obtain quotes.

- Compare the quotes side-by-side, paying attention to coverage details and premiums.

- Select the policy that best meets your needs and budget.

Illustrative Examples of Insurance Policies

Retirement often brings a shift in lifestyle, including driving habits. This necessitates car insurance tailored to the specific needs of retired teachers, acknowledging their likely reduced mileage and perhaps a preference for local travel. Understanding the nuances of these policies is key to securing appropriate coverage.Policies for retired teachers, while sharing similarities with standard policies, often incorporate provisions reflecting their particular circumstances.

This includes potentially lower premiums due to reduced driving frequency and, in some cases, discounts for safe driving history.

Sample Car Insurance Policy for Retired Teachers

This sample policy, designed for retired teachers, focuses on comprehensive coverage for their vehicles, while factoring in their specific needs. It emphasizes affordability and suitable coverage limits, ensuring a secure financial future in case of unforeseen events.

Key Features and Benefits

This policy offers a comprehensive package of coverage, catering to the needs of retired teachers. It’s important to note that specific features and benefits might vary depending on the insurer and the individual policy.

| Feature | Description |

|---|---|

| Liability Coverage | Protects against financial responsibility for damages caused to others in an accident, fulfilling legal obligations. |

| Collision Coverage | Covers damages to your vehicle regardless of who caused the accident, safeguarding your investment. |

| Comprehensive Coverage | Provides protection for your vehicle from incidents other than collisions, such as vandalism, theft, or weather-related damage. |

| Uninsured/Underinsured Motorist Coverage | Offers financial support if you are involved in an accident with a driver who lacks sufficient insurance or is uninsured, ensuring your protection. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers involved in an accident, offering peace of mind and minimizing financial burden. |

| Roadside Assistance | Provides support for breakdowns, lockouts, and other roadside emergencies, ensuring smooth travel and minimal disruption. |

Typical Exclusions and Limitations, Car insurance for retired teachers

It’s crucial to understand the limitations of any insurance policy. Typical exclusions and limitations include pre-existing conditions (if any) on the vehicle, certain types of damage caused by specific activities, and coverage limitations in cases of reckless driving. It’s vital to carefully review the policy document for precise details.

Insurance Claims Scenarios and Policy Responses

Retired teachers might face various claim scenarios. For example, a claim related to vandalism would be covered under the comprehensive coverage component. If a teacher’s car is stolen, the policy’s theft coverage would apply, providing a financial cushion. A collision claim would be addressed by the collision coverage section of the policy, ensuring compensation for vehicle repairs.

Filing an Insurance Claim: A Guide for Retired Teachers

Filing an insurance claim involves several steps. First, contact your insurance provider immediately after an incident. Document the incident thoroughly, including details of the accident, witnesses, and damage to the vehicle. Collect all necessary documentation, such as police reports, medical bills, and repair estimates. Collaborate with your insurance provider throughout the claim process, providing all requested information promptly.

Visual Representation of Data: Car Insurance For Retired Teachers

Retired teachers, like any other demographic, deserve clear and accessible information about their car insurance. Visual representations of data, such as charts and graphs, help in quickly understanding trends and comparisons, making the process more understandable and less daunting.Visualizing data simplifies complex information, allowing for easier interpretation of trends, comparisons, and distributions. This aids in making informed decisions regarding car insurance options.

Average Car Insurance Costs by State

Understanding the variation in car insurance costs across states is crucial for retired teachers. Different states have varying regulations, risk profiles, and economic factors that affect premiums.

| State | Average Annual Premium (USD) |

|---|---|

| California | $1,850 |

| Texas | $1,600 |

| Florida | $1,700 |

| New York | $2,000 |

| Illinois | $1,550 |

Note: These figures are illustrative and based on averages. Individual costs may vary based on specific factors like driving record, vehicle type, and coverage choices.

Distribution of Insurance Claims by Accident Type

Analyzing claim data helps identify common accident types for retired teachers. This information can help insurers and policyholders understand potential risks and adjust premiums accordingly.A pie chart, with slices representing different accident types, can illustrate this distribution. For instance, a slice labeled “rear-end collisions” might be significantly larger than “sideswipes.”Illustrative Pie Chart:

Rear-end collisions

35%

Sideswipes

25%

Parking lot accidents

20%

Road construction accidents

15%

Other

5%

Trend in Car Insurance Premiums Over Time

Tracking premium changes over time helps retired teachers anticipate future costs and adjust their coverage accordingly. This allows for long-term planning and budget management.A line graph showing the trend of car insurance premiums over time would display a fluctuating pattern. For instance, premiums might increase slightly in years with high inflation, or decrease if accident rates decline.Illustrative Line Graph:The line graph would display premiums increasing gradually from 2010 to 2020, with a slight dip in 2018, followed by a steady increase until 2023.

Common Causes of Car Accidents Involving Retired Teachers

Understanding the reasons behind accidents is essential for prevention and cost management. This knowledge enables policyholders to adjust their driving habits and potentially lower their insurance premiums.Infographic:The infographic will present a breakdown of accident causes, using icons and brief descriptions for each cause. For example, it might include icons for distracted driving (cell phone use), speeding, or adverse weather conditions.

Differences in Car Insurance Costs Based on Vehicle Type

Different vehicles have different risks associated with them, impacting insurance costs. This understanding helps retired teachers make informed decisions about vehicle choices and associated costs.A detailed illustration, perhaps a table, could compare costs based on vehicle type, comparing, for example, the insurance costs for a small sedan versus a large SUV.Illustrative Table:| Vehicle Type | Average Annual Premium (USD) ||—|—|| Small Sedan | $1,200 || SUV | $1,500 || Sports Car | $1,800 || Classic Car | $2,000 |These illustrations provide a visual representation of the data, facilitating a deeper understanding of car insurance costs and trends for retired teachers.

Final Thoughts

In conclusion, securing the right car insurance for retired teachers requires careful consideration of individual circumstances and needs. By understanding the various factors that influence costs, comparing policy options, and utilizing available discounts, retired educators can effectively manage their insurance expenses while maintaining adequate coverage. This comprehensive guide equips retired teachers with the knowledge to make informed decisions and secure the protection they need on the road.

FAQ Explained

What are the typical driving habits of retired teachers?

Retired teachers often drive shorter distances and have less frequent trips than younger drivers. Their driving patterns tend to be more predictable and often focused on local errands and appointments.

How do credit scores affect car insurance premiums for retired teachers?

While not always a major factor, credit scores can influence premiums. Insurers may assess creditworthiness as a general measure of risk, although it might not hold the same weight as for other demographics.

Are there specific discounts available for retired teachers?

Some insurance providers offer discounts for senior citizens, which can apply to retired teachers. It’s essential to inquire about these discounts with different insurance companies.

How can I compare different insurance quotes?

Using online comparison tools and contacting multiple insurance providers directly is a great way to compare quotes. Be sure to gather information about coverage details and any potential discounts.