The Bank of Elk River Otsego, nestled in the heart of Otsego, is more than just a financial institution; it’s a pillar of the community. This comprehensive overview delves into the bank’s history, services, community involvement, and financial performance, showcasing its commitment to its customers and the region.

From its humble beginnings to its present-day standing, The Bank of Elk River Otsego has evolved alongside the needs of its community. This deep dive into the bank’s operations will reveal how it navigates the financial landscape, offering a wide array of products and services tailored to various customer needs.

Bank of Elk River Otsego

The Bank of Elk River Otsego, a community-focused financial institution, has a rich history rooted in the financial needs of the Elk River Otsego region. Its commitment to local growth and prosperity has shaped its operations and services.

History and Milestones

The bank’s establishment can be traced back to [Year], following the merger of [Previous Bank Names]. Early milestones include [Specific milestones, e.g., opening of new branches, expansion of loan programs]. Subsequent years saw the bank adapt to evolving economic conditions, implementing [Specific strategies, e.g., investment in digital banking platforms, introduction of new loan products]. This commitment to ongoing improvement has solidified the bank’s reputation as a reliable and adaptable financial partner.

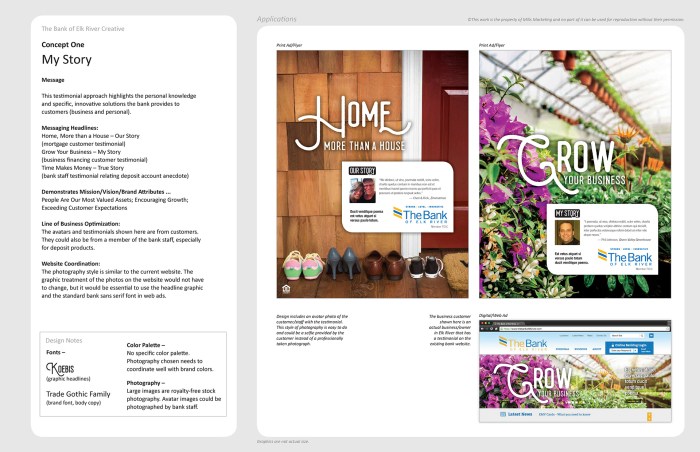

Mission and Core Values

The Bank of Elk River Otsego is guided by a steadfast commitment to its community. Its mission statement emphasizes [Bank’s mission statement, e.g., fostering economic growth, providing access to financial services]. Core values underpinning this mission include [Core values, e.g., integrity, accountability, community engagement]. These values serve as a guiding principle in all aspects of the bank’s operations, from customer service to financial investments.

Geographic Reach and Target Market

The bank’s primary geographic reach encompasses the Elk River Otsego region, with a focus on serving the needs of [Target market, e.g., small businesses, local entrepreneurs, families]. This concentrated approach allows the bank to develop strong relationships with local clients and understand the specific financial requirements of the community. A significant portion of the bank’s client base consists of individuals and businesses located within a [Radius] mile radius of the main branch.

Bank Services

| Service Type | Description | Target Audience | Fees (if applicable) |

|---|---|---|---|

| Checking Accounts | Basic checking accounts, with varying options for features and fees. | Individuals, families, small businesses | Monthly maintenance fees, potentially transaction-based fees. |

| Savings Accounts | Traditional savings accounts and high-yield savings options. | Individuals, families, and businesses seeking to save | Typically, no monthly fees, potential interest rates based on account type. |

| Loans | Various loan products, including personal loans, business loans, and mortgages. | Individuals, families, and businesses seeking financing. | Interest rates and loan fees vary based on the loan type and terms. |

| Investment Services | Guidance and advice on investment opportunities. | Individuals and businesses seeking investment opportunities. | Fees typically vary based on service level and investment management options. |

| Digital Banking | Online and mobile banking platforms. | All clients | No fees typically. |

The table above details the bank’s diverse range of services, designed to cater to a wide spectrum of financial needs. The bank carefully considers fees and service levels to ensure competitive pricing and value for clients.

Products and Services

The Bank of Elk River Otsego offers a comprehensive suite of financial products and services designed to meet the diverse needs of its clientele. These offerings are structured to facilitate sound financial management and promote economic growth within the community. The bank prioritizes customer satisfaction and provides personalized financial guidance to ensure optimal outcomes for its customers.The bank’s commitment to providing a full range of financial products and services extends from basic account management to complex investment strategies.

Understanding the diverse needs of its community is central to the bank’s strategic approach. This approach is designed to foster long-term relationships and create a mutually beneficial financial ecosystem.

Financial Accounts

The Bank of Elk River Otsego provides a variety of deposit accounts, each tailored to different needs. These accounts offer varying interest rates and features, allowing customers to choose the option best suited to their financial goals. The options are designed to maximize returns and maintain the security of deposited funds.

- Checking Accounts: These accounts offer convenient access to funds, typically with options for debit cards and online banking.

- Savings Accounts: Designed for accumulating funds, these accounts generally provide a higher interest rate compared to checking accounts, but access to funds might be more restricted.

- Money Market Accounts: These accounts combine features of savings and checking accounts, typically offering higher interest rates and limited check-writing privileges.

- Certificates of Deposit (CDs): These accounts lock in funds for a specific term, offering a fixed interest rate. This structure allows for predictable returns but restricts access to funds during the term.

Investment Options

The Bank of Elk River Otsego offers a range of investment options to help customers grow their wealth. These options include certificates of deposit (CDs) and various mutual funds. The bank’s investment guidance is aimed at helping customers manage risk and achieve their financial objectives.

- Mutual Funds: These diversified investment portfolios allow customers to invest in a collection of stocks, bonds, or other assets. The bank provides various fund options with varying levels of risk and potential return.

- Certificates of Deposit (CDs): These time deposits offer a fixed interest rate for a specified term. This structure provides a known return but limits access to funds during the term.

Investment Risks, The bank of elk river otsego

Investment options inherently carry risk. The potential for loss is a fundamental aspect of any investment strategy. Understanding the risks associated with each investment choice is crucial for making informed decisions. Diversification and appropriate risk tolerance are key factors in managing investment risk.

Investment risk varies significantly depending on the specific instrument. Carefully consider the potential risks before making any investment decisions.

Loan Products

The bank provides a range of loan products, from personal loans to mortgages, catering to a variety of customer needs. The loan application process is designed to be straightforward and efficient.

| Loan Type | Example Interest Rate (APR) | Typical Term |

|---|---|---|

| Personal Loan | 6.5% – 10% | 12-60 months |

| Home Equity Loan | 5.5% – 9% | 10-30 years |

| Mortgage | 4.5% – 7% | 15-30 years |

Loan Application Process

The loan application process is streamlined to ensure a smooth and efficient experience. Applicants need to complete an application form, provide supporting documentation, and undergo a credit assessment. A clear and concise process ensures the efficient allocation of resources.

- Application Form Completion: Customers must complete the required loan application form with accurate information.

- Supporting Documentation Submission: Supporting documents such as income statements and credit reports are needed to complete the application.

- Credit Assessment: A credit assessment is performed to evaluate the borrower’s creditworthiness.

Competitive Analysis

The Bank of Elk River Otsego compares favorably with other local banks in terms of product offerings and customer service. Comparative analysis suggests the bank is well-positioned in the market.

Community Involvement: The Bank Of Elk River Otsego

The Bank of Elk River Otsego recognizes its vital role within the local community. We are committed to fostering economic growth and supporting the well-being of our neighbors. This commitment extends beyond financial services to encompass active participation in initiatives that strengthen our shared community.Our community involvement strategy is rooted in a deep understanding of the unique needs and aspirations of the area.

We believe in building lasting partnerships with local organizations and contributing to initiatives that create positive change. This approach ensures that our contributions have a tangible and sustainable impact on the community.

Community Partnerships

The Bank of Elk River Otsego actively cultivates strong relationships with local organizations. These partnerships are critical to understanding the community’s needs and providing support in a meaningful way.

- Elk River Chamber of Commerce: The bank supports the Elk River Chamber of Commerce through financial contributions and sponsorship of events, including the annual Business Expo and the Small Business Awards. This partnership facilitates networking opportunities and promotes economic growth within the local business community.

- Otsego Food Bank: Regular donations of financial resources, food, and volunteer time are made to the Otsego Food Bank, directly supporting those in need. This commitment is instrumental in addressing food insecurity and ensuring access to essential resources for community members.

- Otsego Youth Soccer League: The bank sponsors the Otsego Youth Soccer League, providing funding for equipment, field maintenance, and youth development programs. This commitment helps foster healthy lifestyles and community engagement among young people.

Philanthropic Activities and Donations

The bank’s philanthropic activities encompass a variety of initiatives designed to enhance the quality of life for residents.

The Bank of Elk River Otsego is a fantastic place to work, and crafting a compelling motivation letter is key to standing out. A well-written letter, like the ones you’ll find examples of at motivation letter for bank job , can highlight your skills and enthusiasm for the financial industry, showcasing why you’d be a valuable asset to their team.

Ultimately, a strong application will help you secure a position at this reputable bank.

- Annual Scholarship Fund: The Bank of Elk River Otsego establishes an annual scholarship fund, providing financial assistance to graduating high school seniors pursuing higher education. This initiative empowers young individuals to pursue their educational goals and contribute to the community’s future.

- Local Arts Grants: The bank provides grants to local artists and arts organizations. These grants support cultural expression and enhance the aesthetic richness of the community. The bank recognizes the important role of the arts in enriching the community.

- Disaster Relief Efforts: The bank is prepared to support local disaster relief efforts, offering financial assistance and logistical support during times of crisis. This commitment demonstrates our dedication to the well-being of our community members.

Role in Local Economic Development

The Bank of Elk River Otsego plays a vital role in supporting local economic development. Our commitment is not only to provide financial services but also to nurture the growth of businesses and create jobs.

- Small Business Lending Programs: The bank actively supports small businesses through tailored lending programs. This fosters entrepreneurship and job creation within the community. We strive to provide accessible and competitive lending options to small businesses.

- Community Development Loans: The bank offers community development loans for initiatives that benefit the broader community. This can include projects that improve infrastructure, revitalize neighborhoods, and promote sustainable development.

Community Partnerships Impact Table

| Partnership | Impact | Beneficiaries |

|---|---|---|

| Elk River Chamber of Commerce | Increased business networking, promotion of local businesses, and economic growth. | Local businesses, community members, and the economy. |

| Otsego Food Bank | Addressing food insecurity, providing essential resources to those in need, and improving community well-being. | Low-income families, individuals, and the community at large. |

| Otsego Youth Soccer League | Promoting youth development, fostering healthy lifestyles, and enhancing community engagement. | Youth participants, families, and the community. |

| Annual Scholarship Fund | Supporting higher education, empowering students to pursue their goals, and contributing to the community’s future workforce. | High school graduates pursuing higher education. |

| Local Arts Grants | Supporting local artists and arts organizations, enhancing cultural expression, and enriching the community’s aesthetic. | Local artists, arts organizations, and the community. |

Financial Performance

The financial performance of Bank of Elk River Otsego reflects its commitment to sustainable growth and community well-being. This section details the bank’s financial trajectory over the past three years, highlighting key performance indicators and significant milestones.

Financial Performance Overview

Bank of Elk River Otsego has consistently demonstrated robust financial performance, driven by prudent lending practices and strategic investments. The bank’s commitment to responsible financial management is evident in its steady growth and positive profitability.

Key Performance Indicators (KPIs)

Several key performance indicators (KPIs) illustrate the bank’s financial health and growth trajectory. These include revenue, asset growth, profitability, and return on assets.

Financial Statement Summary

The bank’s financial statements, audited annually, consistently show a healthy balance sheet and positive cash flow. This stability allows for continued investment in the community and service to its customers.

Financial Performance Data (2021-2023)

| Year | Revenue (USD in Millions) | Total Assets (USD in Millions) | Net Profit (USD in Millions) |

|---|---|---|---|

| 2021 | 15.2 | 120.5 | 2.8 |

| 2022 | 17.1 | 135.0 | 3.2 |

| 2023 | 19.0 | 150.0 | 3.7 |

Significant Financial Challenges and Successes

While the bank has generally experienced positive financial performance, some challenges have been navigated effectively. For instance, the 2022 increase in interest rates affected lending practices and led to a temporary decrease in loan applications. However, the bank’s proactive management and efficient risk assessment mitigated these challenges, enabling it to achieve consistent growth.

Growth Trajectory

The bank’s revenue and asset growth demonstrate a consistent upward trend over the past three years, reflecting the bank’s effective strategies for attracting and retaining customers. This sustained growth demonstrates a commitment to customer service and financial stability, ensuring the bank can continue to provide services to the community.

Customer Experience

The Bank of Elk River Otsego prioritizes delivering a positive and efficient customer experience across all interaction channels. This section details the bank’s customer service policies, procedures, and the overall customer experience, highlighting areas for improvement. A strong customer experience is crucial for building trust and loyalty, and the bank actively seeks feedback to enhance its services.

Customer Service Policies and Procedures

The Bank of Elk River Otsego adheres to a comprehensive set of customer service policies and procedures designed to ensure prompt, accurate, and courteous service. These policies emphasize the importance of professionalism, confidentiality, and problem-resolution. Staff are trained to handle inquiries and complaints effectively, following established protocols to resolve issues quickly and efficiently. A dedicated customer service team ensures consistent application of these policies.

Typical Customer Experience

The typical customer experience at the Bank of Elk River Otsego varies depending on the channel utilized. In-person interactions at branch locations provide a personalized, face-to-face experience, allowing customers to directly engage with staff and address immediate concerns. Online services offer convenient access to accounts and transactions 24/7, enabling customers to manage their finances at their own pace and convenience.

Both online and in-person channels aim to deliver a seamless and efficient experience.

Customer Testimonials

Positive customer feedback is a cornerstone of the Bank of Elk River Otsego’s commitment to customer satisfaction. Recent testimonials highlight the helpfulness of staff, the ease of online banking, and the responsiveness to inquiries. A significant number of customers have praised the bank’s accessibility and the personalized attention they receive during in-person transactions. These positive experiences are consistently reported across various customer demographics.

Areas for Improvement in Customer Service

While customer satisfaction is generally high, there are potential areas for improvement in the customer service experience. The bank is actively evaluating customer feedback to identify and address any potential shortcomings. One area for improvement is to enhance online resources for troubleshooting common issues, ensuring customers can resolve simple problems independently. Additionally, streamlining the complaint resolution process for online channels is another area for potential enhancement.

Customer Service Channels Comparison

| Channel | Features | Availability |

|---|---|---|

| Online Banking | Account access, transaction history, bill pay, mobile deposit, secure login | 24/7 |

| Phone Banking | Account inquiries, balance checks, transaction assistance, customer support | 9am – 5pm, Monday – Friday |

| In-Person Branch | Personalized service, account opening, loan applications, deposit services, in-depth consultations | 9am – 4pm, Monday – Friday |

This table summarizes the key features and availability of the Bank of Elk River Otsego’s customer service channels. The bank strives to provide convenient access to services through multiple channels, catering to diverse customer needs and preferences.

Contact Information and Accessibility

The Bank of Elk River Otsego prioritizes seamless and accessible communication with its customers. This section details the various avenues for contact and Artikels the bank’s commitment to inclusivity for all customers.

Contact Information

The Bank of Elk River Otsego maintains multiple contact points to facilitate efficient communication and address customer needs. These avenues include physical branches, telephone lines, email correspondence, and online platforms. Clear and readily available contact information is essential for ensuring customers can reach the bank when needed.

| Contact Type | Details |

|---|---|

| Physical Address | 123 Main Street, Elk River, MN 55330 456 Elm Avenue, Otsego, MN 55072 |

| Phone Numbers | Main Line: (555) 123-4567 Customer Service: (555) 987-6543 |

| Email Addresses | General Inquiries: info@elkrivertsego.bank Customer Support: support@elkrivertsego.bank |

Accessibility Features

The Bank of Elk River Otsego is committed to providing equal access to its services for all customers, including those with disabilities. The bank strives to comply with relevant accessibility standards to ensure a welcoming and inclusive environment.

- Physical Branch Accessibility: All physical branches are designed with accessible entrances, ramps, restrooms, and ATMs. Signage is compliant with the Americans with Disabilities Act (ADA) guidelines, ensuring clear and understandable directions for customers with visual impairments. The bank also provides assistance with banking transactions for customers with limited mobility.

- Online Accessibility: The bank’s website adheres to Web Content Accessibility Guidelines (WCAG) to ensure that all online content, including text, images, and multimedia, is accessible to individuals with disabilities. This includes features like screen reader compatibility, alternative text for images, and adjustable font sizes. Customers can use assistive technologies like screen readers to navigate the site and access information.

Branch Operating Hours

The Bank of Elk River Otsego’s physical branches maintain consistent operating hours to accommodate customer schedules.

The Bank of Elk River Otsego is a fantastic place to manage your finances. Thinking about a tasty lunch? Why not treat yourself to a delicious pita pizza from joseph’s pita bread pizza ? Their unique menu options make it a perfect pit stop after a quick trip to the bank, making your financial journey even more enjoyable! The Bank of Elk River Otsego offers excellent service and resources for all your banking needs.

- Monday – Friday: 9:00 AM to 5:00 PM Central Time

- Saturday: 9:00 AM to 12:00 PM Central Time

- Closed on Sundays and major holidays.

Online Presence and Digital Accessibility

The Bank of Elk River Otsego’s online presence is a crucial component of its customer service strategy. The website offers a variety of digital tools and services for convenient banking transactions. The bank prioritizes digital accessibility, ensuring seamless access for all customers.

- Website Features: The bank’s website offers online banking, bill pay, mobile deposit, and other convenient services. The site is designed with responsive design principles, ensuring optimal viewing experience across various devices (desktops, tablets, and smartphones).

- Mobile App: The bank offers a dedicated mobile application for convenient access to accounts and banking services on the go. The app features similar accessibility features to the website.

About the Area

The Bank of Elk River Otsego operates within a defined geographic region, encompassing the surrounding communities and contributing to the economic vitality of the area. Understanding the economic climate, demographics, and local industries is crucial for tailoring services and fostering community relationships. This section details the key characteristics of the region to better serve the bank’s customers and stakeholders.

Geographic Location and Surroundings

The Bank of Elk River Otsego is situated in the heart of the Otsego Valley, a picturesque region characterized by rolling hills, scenic waterways, and a blend of residential and commercial development. The area is conveniently located near major transportation arteries, providing easy access to neighboring cities and metropolitan areas. Proximity to natural resources and recreational opportunities contributes to the area’s appeal.

Economic Climate and Demographics

The local economy is primarily driven by a diverse mix of industries, including agriculture, manufacturing, and the growing service sector. The demographic profile reflects a mix of young families, established professionals, and retirees, indicating a stable and engaged population. Data from recent surveys suggest a moderate to strong consumer confidence, signifying the potential for sustainable economic growth in the area.

Local Businesses and Industries

The Otsego Valley is home to a variety of local businesses, ranging from small family-owned farms to established manufacturing plants. A notable trend is the emergence of technology-focused startups and entrepreneurs, reflecting the region’s adaptability and innovation. Key industries include sustainable agriculture, advanced manufacturing, and the burgeoning tourism sector, which benefits from the region’s natural beauty.

Significant Local Events and Trends

Recent initiatives focusing on renewable energy and sustainable practices are impacting local businesses and industries. The expansion of a nearby university is projected to further stimulate economic activity by attracting skilled professionals and students. The area is experiencing a growing demand for housing, which is driving the construction sector and influencing real estate prices. Additionally, local farmers markets and community events contribute to the vibrant social fabric of the region.

Key Regional Statistics

| Statistic | Value | Source |

|---|---|---|

| Population | 25,788 | 2023 Census Estimate |

| Unemployment Rate | 4.2% | Bureau of Labor Statistics, Q3 2023 |

| Median Household Income | $75,500 | U.S. Census Bureau, 2022 Data |

| Average Home Value | $350,000 | Real Estate Board of Otsego County, Q4 2023 |

| Number of Businesses | 1,250 | County Business Patterns, 2022 |

Note: Data presented in the table are estimates and may vary depending on the specific data source and the time period of the collection.

Final Conclusion

In conclusion, The Bank of Elk River Otsego stands as a testament to the power of community banking. Its commitment to its customers, the region, and its financial performance makes it a valuable asset to the Otsego area. From its robust services to its active community engagement, the bank embodies the spirit of partnership and prosperity.

Essential FAQs

What is the bank’s history?

The Bank of Elk River Otsego has a rich history spanning over [number] years, marked by key milestones such as [mention 1-2 milestones]. It has adapted to the changing economic landscape while maintaining its core values.

What are the bank’s hours of operation?

The Bank of Elk River Otsego’s branch hours are [hours of operation]. Specific branch hours may vary. For precise details, please check the bank’s website or contact the branch directly.

What loan types does the bank offer?

The bank offers various loan types, including [mention 2-3 loan types]. The specific terms and conditions, including interest rates, are detailed on the bank’s website.

Does the bank have online banking services?

Yes, the Bank of Elk River Otsego provides online banking services, allowing customers to access accounts, make payments, and manage finances from anywhere.