Example of auto insurance card: Understanding your policy is crucial. This guide delves into the details of auto insurance cards, explaining their formats, information, and practical applications. Learn how to interpret the card, use it for various purposes, and even compare different insurance provider cards.

From the typical layout to the essential information, this guide breaks down the complexities of auto insurance cards. This will help you confidently navigate insurance-related situations and ensure you have the right coverage. Knowing your insurance card inside and out is important for protecting yourself.

Overview of Auto Insurance Cards

An auto insurance card is a vital document, a testament to your vehicle’s protection. It serves as a quick reference, providing essential details about your coverage and policy. Understanding its format and content empowers you to quickly verify your insurance information when needed, be it at an accident scene or during a routine inspection.The card’s design, while often standardized, does exhibit some variations across insurance providers.

This flexibility allows for the inclusion of unique identifiers and company logos, while ensuring clarity and crucial information accessibility. This document delves into the standard layout and common variations, highlighting the essential details for a comprehensive understanding.

Typical Format and Layout

Auto insurance cards are typically designed in a compact, easily portable format. This design prioritizes accessibility and allows for quick verification of coverage details. The layout generally features clear sections, organized to present pertinent information at a glance. A visually appealing and well-structured layout aids in readability and immediate comprehension.

Essential Information on an Auto Insurance Card

The core information found on an auto insurance card includes the policyholder’s name and contact details, along with the policy number. Critically, it also displays the vehicle identification number (VIN), the type of coverage, and the effective dates of the policy. These components collectively form a crucial reference for identifying the insured vehicle and policy.

Variations in Design and Content Across Providers

While the fundamental structure remains consistent, insurance companies often adapt their design and content to align with their branding. This might involve subtle variations in color schemes, font styles, or the inclusion of unique identifiers. These variations, while not affecting the core information, contribute to the company’s visual identity.

How Card Format Differs Based on Coverage Type

The format of an auto insurance card may differ slightly based on the type of coverage. Liability coverage cards, for example, may primarily focus on the insured’s legal responsibilities in case of accidents, while comprehensive coverage cards might emphasize the broader protections offered. This adjustment in focus ensures the card’s content accurately reflects the specific coverage details.

Typical Sections of an Auto Insurance Card

| Section | Description |

|---|---|

| Policyholder Information | Includes the policyholder’s name, address, phone number, and email address. |

| Policy Number | A unique identifier for the insurance policy. |

| Vehicle Information | Lists the vehicle’s year, make, model, and VIN. |

| Coverage Details | Artikels the types of coverage included (e.g., liability, collision, comprehensive). |

| Effective Dates | Indicates the start and end dates of the policy. |

| Insurance Company Information | Includes the company name, address, and contact information. |

Information on the Card

My dear reader, this card, a testament to your financial security, is more than just a piece of paper. It is a compact compendium of vital information regarding your auto insurance policy. Understanding its contents empowers you, providing peace of mind and clarity in case of an unforeseen event. Let us delve into the details.This card serves as a quick reference guide, consolidating key policyholder and policy information in one convenient place.

It’s designed to provide immediate answers, ensuring you’re prepared should you need to contact your insurance provider or file a claim.

A standard auto insurance card typically displays crucial details like policy number, coverage limits, and contact information. Navigating the complexities of renting, especially when considering purchasing a home, often involves exploring options like can i break my lease if i buy a house. Ultimately, having a readily accessible auto insurance card is vital for smooth transactions and ensures your vehicle’s protection.

Policyholder Identification

The card meticulously details the policyholder’s information, acting as a vital identification marker. This crucial information typically includes the policyholder’s full legal name, address, phone number, and email address. Accurate details facilitate prompt claim processing and communication, ensuring your policy benefits are delivered effectively.

Policy Location

The card efficiently guides you to the specifics of your policy. It contains the policy number, which is unique to your insurance agreement. This number, often represented as a series of numbers and letters, is the cornerstone of your policy, allowing you to locate all relevant documents and information associated with your contract.

The Significance of the Policy Number

The policy number is a unique identifier that distinguishes your policy from others. It acts as a key to your policy’s details, allowing you to access information, make inquiries, and file claims smoothly. Think of it as the unique fingerprint of your insurance agreement. This number is fundamental in all correspondence with your insurance provider.

Coverage Limits

Understanding your coverage limits is paramount. The card will clearly Artikel the monetary limits of your policy for various types of coverage. These limits are expressed in specific numerical amounts for liability, collision, comprehensive, and uninsured/underinsured motorist coverage. This clarity allows you to readily assess your financial protection. For example, a liability coverage limit of $100,000 signifies the maximum payout the insurer will make to a third party in a liability claim.

Vehicles Covered

The card also lists the vehicles covered under your policy. It typically includes the vehicle identification number (VIN) or a description of the vehicles, like the make, model, and year. This ensures that only the vehicles listed are protected under your insurance policy.

Types of Auto Insurance Coverage, Example of auto insurance card

| Coverage Type | Description | Card Representation |

|---|---|---|

| Liability | Covers damages you cause to others in an accident. | Amount in USD |

| Collision | Covers damage to your vehicle regardless of who is at fault. | Amount in USD |

| Comprehensive | Covers damage to your vehicle from events other than collisions, like theft, vandalism, or natural disasters. | Amount in USD |

| Uninsured/Underinsured Motorist | Covers damages if the other driver involved is uninsured or has insufficient coverage. | Amount in USD |

This table summarizes the most common types of auto insurance coverage and how they are typically displayed on the card. Each type provides a distinct layer of protection, safeguarding your interests in various accident scenarios.

Practical Applications and Uses

My dear reader, your auto insurance card is more than just a piece of paper; it’s your trusted companion on the road, a silent guardian ensuring your safety and peace of mind. It holds the key to navigating various situations, from routine interactions to unexpected circumstances. Let us delve into its practical applications.Understanding the importance of your auto insurance card is paramount.

It serves as a tangible proof of your coverage, facilitating smooth interactions with authorities and insurance providers in case of an accident or other incidents. This document embodies your protection, providing critical information for both you and the involved parties.

Proving Insurance Coverage During a Traffic Stop or Accident

Your auto insurance card is your first line of defense during a traffic stop or accident. It readily displays your insurance details, allowing law enforcement officers to quickly verify your coverage status. This verification process is crucial for ensuring compliance with traffic regulations and preventing potential penalties. Presenting the card immediately demonstrates your commitment to responsible driving and helps avoid unnecessary delays or complications.

For example, if you’re involved in a minor fender bender, the insurance card will quickly confirm your coverage, enabling a swift resolution to the incident.

Securing your auto insurance is crucial; a clear example of an auto insurance card will detail coverage specifics. Planning a memorable birthday party for a ten-year-old in Melbourne requires careful consideration of venues. Finding the perfect spot for such an occasion can be made easier by checking out reputable resources like 10 year old birthday party places melbourne.

Ultimately, a comprehensive auto insurance card remains a vital document for drivers.

Role in Resolving Insurance Claims

The insurance card plays a vital role in the claims resolution process. It provides the necessary information for insurance companies to process your claim accurately and efficiently. The card contains crucial details like your policy number, insurer’s name, and contact information, which are essential for initiating and tracking your claim. Presenting the card promptly to the insurance adjuster facilitates a smoother and faster claim settlement process, ultimately ensuring you receive the compensation you deserve.

Verifying Insurance Status for Various Purposes

Beyond traffic stops and accidents, your auto insurance card is a valuable tool for verifying your insurance status for various purposes. For instance, it’s required by some rental companies to confirm your coverage, offering peace of mind and allowing you to enjoy your rental vehicle without worrying about potential liability. Additionally, it may be needed during vehicle registration renewals or when dealing with other related administrative processes.

Common Reasons for Needing an Auto Insurance Card

There are several common reasons why you might need your auto insurance card. These situations highlight the card’s importance and demonstrate how it helps you navigate everyday driving responsibilities. These reasons include:

- Traffic stops: Police officers need to verify your insurance coverage during traffic stops, especially when a violation or accident is involved. This verification ensures compliance with traffic laws and helps prevent potential penalties.

- Accidents: In case of an accident, your insurance card is crucial for quickly confirming your coverage and initiating the claims process.

- Rental car agreements: Rental companies often require proof of insurance coverage, typically through your auto insurance card, to ensure adequate protection against potential damage or liability.

- Vehicle registration renewals: Some jurisdictions require proof of insurance during vehicle registration renewals, further emphasizing the card’s importance in maintaining your vehicle’s legal status.

Retrieving a Lost or Damaged Auto Insurance Card

In the unfortunate event of losing or damaging your auto insurance card, obtaining a replacement is a straightforward process. The following table Artikels the steps involved:

| Step | Action |

|---|---|

| 1 | Contact your insurance company immediately. |

| 2 | Provide your policy number and other necessary details to the insurance representative. |

| 3 | Follow the instructions provided by the insurance company for requesting a replacement card. |

| 4 | Request the card be sent to your current mailing address, or obtain it in person if possible. |

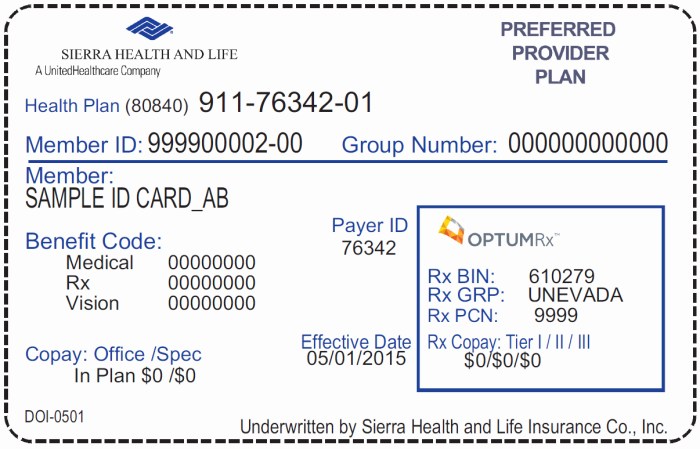

Visual Representation of an Auto Insurance Card

My dear friend, let us delve into the beautiful world of auto insurance cards, exploring their visual representation, from the simple physical card to the sophisticated digital counterpart. Understanding these visual elements is crucial for quickly and easily accessing vital information about your coverage.The design of an auto insurance card plays a vital role in providing a clear and concise summary of your policy details.

A well-designed card ensures that essential information is easily accessible and readily understood.

Sample Physical Auto Insurance Card

A physical auto insurance card, often a plastic or laminated card, is a tangible representation of your policy. Its layout is crucial for efficient information retrieval. A well-structured card will feature clearly presented information in a way that is easy to comprehend at a glance.

| Field | Description |

|---|---|

| Policy Number | A unique identifier for your policy. |

| Insured’s Name | The name of the policyholder. |

| Vehicle Information | Details about the insured vehicle(s), including make, model, year, and VIN. |

| Policy Effective Dates | Start and end dates of the policy coverage. |

| Insurer’s Name and Address | Information about the insurance company issuing the policy. |

| Contact Information | Phone number, email address, and website for customer service. |

| Coverage Details | Summary of the coverages included in the policy, such as liability, collision, comprehensive. |

| Deductible Amount | The amount the policyholder is responsible for paying out of pocket before the insurance company covers expenses. |

| Policyholder Signature | A signature field for authentication. |

Digital Auto Insurance Card Layout

A digital auto insurance card offers a more versatile and convenient alternative to the physical card. The digital card format allows for easier updates and access to policy details from various devices. This innovative approach streamlines information retrieval and ensures quick access to important policy information.Digital cards are usually accessed through a mobile application or online portal. They can be customized to match the policyholder’s preferences and provide a personalized experience.

The format can easily be adjusted to showcase a concise yet comprehensive summary of your insurance coverage.

Comparison of Physical and Digital Cards

This table illustrates a comparative overview of physical and digital insurance cards, highlighting their respective strengths and weaknesses.

| Feature | Physical Card | Digital Card |

|---|---|---|

| Portability | Easily carried, accessible in person. | Accessible anywhere with a mobile device. |

| Accessibility | Limited to physical possession. | Accessible anytime, anywhere. |

| Updates | Requires a new card for policy changes. | Instant updates reflected in the app. |

| Security | Physical protection against theft. | Protected by device security and app protocols. |

| Cost | Generally lower initial cost. | Generally lower long-term cost due to reduced printing and distribution. |

Visual Elements of an Auto Insurance Card

The visual design of an auto insurance card should prioritize clarity and ease of reading. A legible font, appropriate color scheme, and well-organized layout are essential. The font should be easy to read, preferably sans-serif, in a size large enough to be seen from a distance. The color scheme should be balanced and contrast well to improve readability.

Use of white space is also important to avoid a cluttered look, making it easier to locate the information you need. Consistent formatting and clear labeling will further improve the card’s usability.

Comparing Different Auto Insurance Cards: Example Of Auto Insurance Card

My dear students of the art of insurance, let us embark on a journey to explore the fascinating world of auto insurance cards, understanding their subtle differences and nuances. Each card, a miniature testament to a provider’s approach, holds unique insights into their service philosophy and the value they offer.A careful comparison reveals not just the obvious, but also the subtle distinctions in coverage, benefits, and the overall experience they promise.

This exploration will illuminate the intricate tapestry of offerings, helping you, the discerning consumer, make an informed decision.

Variations in Provider-Specific Features

Understanding the unique features embedded in different auto insurance cards is paramount to choosing the right fit. Each provider, with its own history and clientele, crafts a card that embodies its unique identity. Some may prioritize comprehensive coverage, evident in the detailed descriptions of various protection plans. Others might focus on streamlined processes, highlighting their innovative digital interfaces for quick claim submissions.

These distinctive features often serve as the bedrock of a provider’s identity and commitment to its customers.

- Some cards prominently feature a dedicated customer service hotline, emphasizing a direct line to support. Others may rely on an extensive online portal, allowing customers to manage their policies and claims through a user-friendly interface. Each choice reflects a provider’s strategic approach to customer engagement and service delivery.

- A few cards might emphasize roadside assistance, displaying an extensive list of covered services, from tire changes to fuel delivery. These cards, for example, are attractive to those valuing peace of mind in unforeseen circumstances.

Levels of Detail and Omitted Information

The level of detail on an auto insurance card varies significantly between providers. Some cards offer a concise summary of key coverage aspects, while others provide extensive information on exclusions, limitations, and additional benefits. The level of detail presented often reflects the provider’s approach to transparency and customer engagement. A card packed with intricate details might suggest a more comprehensive policy, while a simplified card might be designed for ease of understanding and quick reference.

- Sometimes, providers intentionally omit certain details, perhaps focusing on a specific segment of the market. For example, cards targeted at young drivers might emphasize accident forgiveness programs, while those designed for seasoned drivers might focus on comprehensive coverage options.

- Other information, such as specific policy numbers or claim history, might be omitted or placed on separate documents, emphasizing the importance of reviewing the full policy documents for a complete picture.

Comparing Insurance Provider Cards

This table highlights key differences between several auto insurance providers. Each provider’s approach to card design and the information presented gives a valuable insight into their philosophy and the benefits offered. Understanding these subtle distinctions is critical to selecting the best option.

| Insurance Provider | Key Features on Card | Level of Detail | Omitted Information |

|---|---|---|---|

| Company A | Emphasis on accident forgiveness programs, digital claim process | Moderate | Detailed policy conditions, specific coverage limits |

| Company B | Comprehensive coverage description, roadside assistance | High | Simplified summary of liability coverage |

| Company C | Focus on customer service hotline, user-friendly online portal | Low | Specific coverage exclusions, premium details |

Final Review

In conclusion, an auto insurance card serves as a vital document, confirming your coverage and simplifying claim procedures. By understanding its various elements and practical uses, you can confidently handle any situation requiring insurance verification. We hope this comprehensive guide has provided you with valuable insights into your auto insurance card.

FAQ Compilation

What if my auto insurance card gets lost or damaged?

Contact your insurance provider to request a replacement. They’ll guide you through the process, often providing online or phone options.

How do I find my policy number on the card?

The policy number is a crucial piece of information typically located prominently on the card, often in a dedicated section.

What are the different types of auto insurance coverage?

Different types of coverage, like liability, collision, and comprehensive, are typically noted on the card. Each coverage type has different limits.

Can I use the card to prove my insurance at a traffic stop?

Yes, your insurance card is a vital document for verifying your coverage during a traffic stop or other insurance-related situations.